SWOT ANALYSIS

WEAKNESSES

-

The weaknesses of the SPREDD region are significant and represent decades of unfortunate events and circumstances. There is no special project or event that will resolve all of these weaknesses in the near-term; however, the formation of SPREDD and the enhanced collaboration noted is a significant step in the right direction and aligns with many plans formulated to address singular and multiple weaknesses noted.

The largest existing weakness is the poor economy within the region and throughout Puerto Rico. Since 2006, Puerto Rico has lost nearly 239,000 jobs, or 22% of its employment base.[1] Many stakeholders have cited the resulting “flight of talent” as a key weakness.

The region, and all of Puerto Rico, is burdened by expensive and unreliable power. A basic component for a competitive economy is an inexpensive, reliable, and abundant source(s) of electricity. By contrast, Puerto Rico’s power is limited, expensive and unreliable. Based on the latest information from the U.S. Energy Information Administration (EIA), Puerto Rico pays 2.64x per kWh than the U.S. average for industrial power. The current rates in Table 6 are also a function of low energy prices due to lower demand as a result of COVID-19. Residential rates per kWh in recent years have been near 30 cents/kWh. A stated “goal” is to Puerto Rico’s energy policy is to create a price of electricity of 20 cents/kWh. This metric alone may eliminate the SPREDD region for consideration by site selectors.

The deterioration of the energy generation and distribution system from lack of investment and the resulting unreliability and lack of resilience have also been cited by stakeholders as a weakness for the region (and Puerto Rico). With respect to quantifying reliability, according to the 2020 report from PREPA, customers experienced an average of one hour per month without power, or 12 hours annually, which is 3x the average time without power for the U.S., according to EIA.

Hawaii, like Puerto Rico, is also burdened by high electricity costs, as there are no oil or natural gas reserves and fuel (for non-renewable sources) must be imported. In order to overcome this weakness, the entire energy generating and distribution system may have to be redesigned, according to stakeholder feedback.

The region, as well as all of Puerto Rico has a large underground economy. When the Recovery Plan was being compiled, the underground economy was estimated to be approximately 25% of the total economy by economists from RAND Corporation. The development of an underground economy is often the result when there is widespread poverty, excessive regulations (permitting process) and a regressive (10.5% sales tax) tax structure. Stakeholders have commented that opportunities must be presented that overshadow the underground economy.

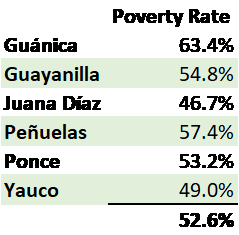

Within the SPREDD region, as well as throughout Puerto Rico, the high levels of poverty often result in people building their own homes, which are not compliant with the codes needed for these structures to withstand hurricanes and earthquakes. Enforcement of this is a challenge for local officials, as shelter is a basic human need; however, these structures will continue to be vulnerable to future disasters and will negate many of resiliency initiatives.

The region is burdened by a poverty rate of 52.6%.[1]

High poverty signals a lack of resources, which in turn may make implementing some of the initiatives more challenging. The lack of resources has also resulted in a call for a partnering and a higher collective capacity, which are key reasons for the formation of SPREDD.

The ongoing reorganization under Title III of PROMESA severely limits access to the capital markets for certain initiatives. Puerto Rico’s new governor, Pedro Pierluisi, has made getting Puerto Rico out of Title III bankruptcy “as quickly as possible” a priority. Additionally, Puerto Rico has recently been able to advance initiatives under the public-private partnership model, as evidenced by the recent agreement between LUMA Energy and Puerto Rico’s Public-Private Partnerships (P3) Authority and the Puerto Rico Electric Power Authority (PREPA) for the operation of the transmission and distribution of the electrical grid.

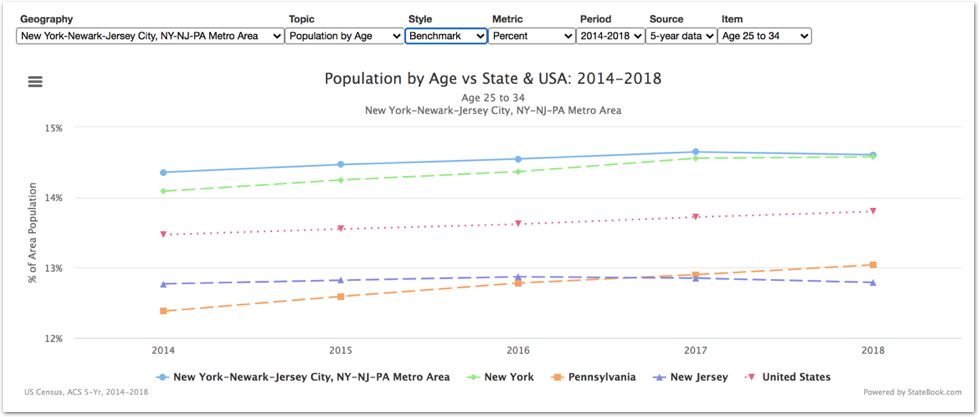

Outmigration of skilled labor and a low labor force participation rate. (See Pages 2 – 2)

Some stakeholders fear that the strength of the unions in San Juan will be an obstacle to full development and realization of the Port of Ponce/Port of the Americas.

There is limited capital available for small business expansion and entrepreneurial startups. This weakness has been noted in many economic plans and by numerous stakeholders during the CEDS process.

Over-regulation, excessive bureaucracy, an “unbearable” permitting process, and lack of government support were cited as issues from many stakeholders. This is also consistent with Puerto Rico scoring poorly in permitting in the World Bank’s Ease of Doing Business Rankings. (It should be noted that in the World Bank’s rankings, Puerto Rico is evaluated as a single country, whereas all 50 states are collectively evaluated as the U.S.) Ease of doing business is also a recurring theme in the Recovery Plan as well. In 2018 steps were taken to allow for “at will” employment in Puerto Rico by means of reversing Law 80; however, legislative efforts to change this failed.

The cumbersome permitting process may also be a function of the excess government, as indicated by the high LQ for Public Administration. (See Chart 10 on Page 2.) For example, the Municipality of Ponce is the second-largest employer in the region, with 2,226 employees[1], or one employee for every 59 residents. According to CityStats, for cities with more than 60,000 residents, there is typically one employee for every 112 residents, indicating that the largest municipality (by population) in the region has nearly 2x the number of municipal employees.

Despite the high number of employees in the Public Administration sector, stakeholders have also complained about the “lack of participatory processes where government can get feedback and guidance from industry experts.” A lack of support from Puerto Rico tourism officials was also noted by stakeholders.

Poor communication infrastructure in rural areas of the region was cited by several stakeholders; however, independent information on internet speeds in the region was not present on the National Broadband Availability Map. FCC maps of broadband availability are often not reliable, based on the reporting requirements. By FCC reporting standards, if one square foot of a census tract is covered by broadband, then the entire tract is “deemed” to be covered.

The region lacks economic development professionals. As a result, the SPREDD region may not be on the radar of site selectors, and existing companies may not receive needed support, according to stakeholders.

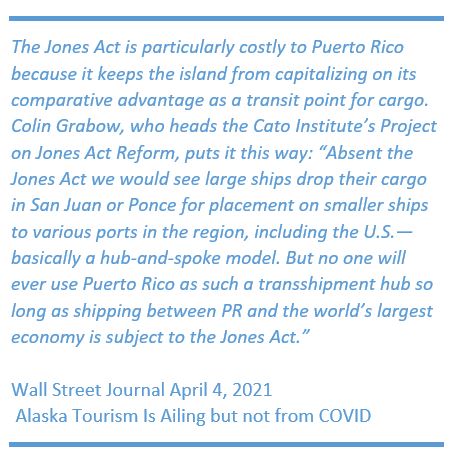

The Jones Act limits opportunities for development at the Port of the Americas/Ponce, as well as other ports in the SPREDD region. Numerous studies have indicated the Jones Act hurts Puerto Rico, while numerous studies supported by proponents of the Jones Act disagree.

Mercedita International Airport in Ponce offers limited connectivity. The airport is serviced by JetBlue and Spirit Airlines; however, departing flights often leave late at night/very early in the morning, which is not very conducive for business or leisure travel.

Some coral reefs are in poor health. This weakness could also be a means to advance the Ocean Economy, as key stakeholders in the region are communicating with officials in Hawaii regarding methods to revitalize coral reefs.

Stakeholders in the agricultural industry claim that many prospective workers prefer to receive government assistance, as opposed to the hard work and low pay associated with agriculture, which limits the potential of certain agricultural initiatives.

The inventory tax is a hinderance to economic development. Some of the most vocal complaints about this tax have come from farmers who claim the tax applies to agricultural supplies, inputs and equipment. This tax is levied at the municipal level.

[1] Puerto Rico Department of Labor Q3 2019

[1] U.S. Census Bureau ACS 5-year 2019

[1] U.S. Bureau of Labor Statistics QCEW

- Telecommuting opportunities • High Level Health Care System:

- Level I-IV trauma centers

- Four major hospital systems/clinical trials

- Life sciences capabilities, especially through UC Davis

- Diversifying Economy in Key Clusters o Manufacturing companies

- Food and Agriculture sector

- California Mobility Center

- Education & Workforce Training Systems